Qualcomm’s latest move just shook up the AI world, and Wall Street is taking notice.

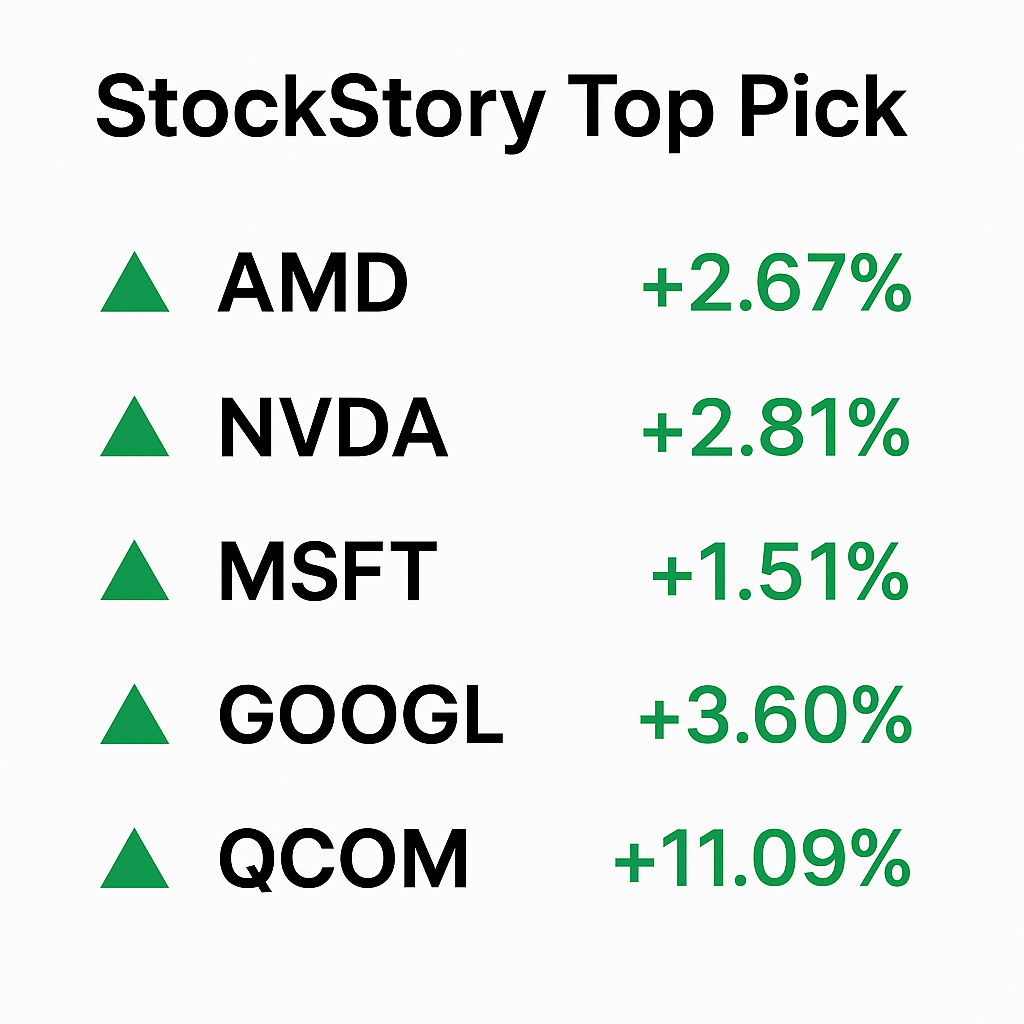

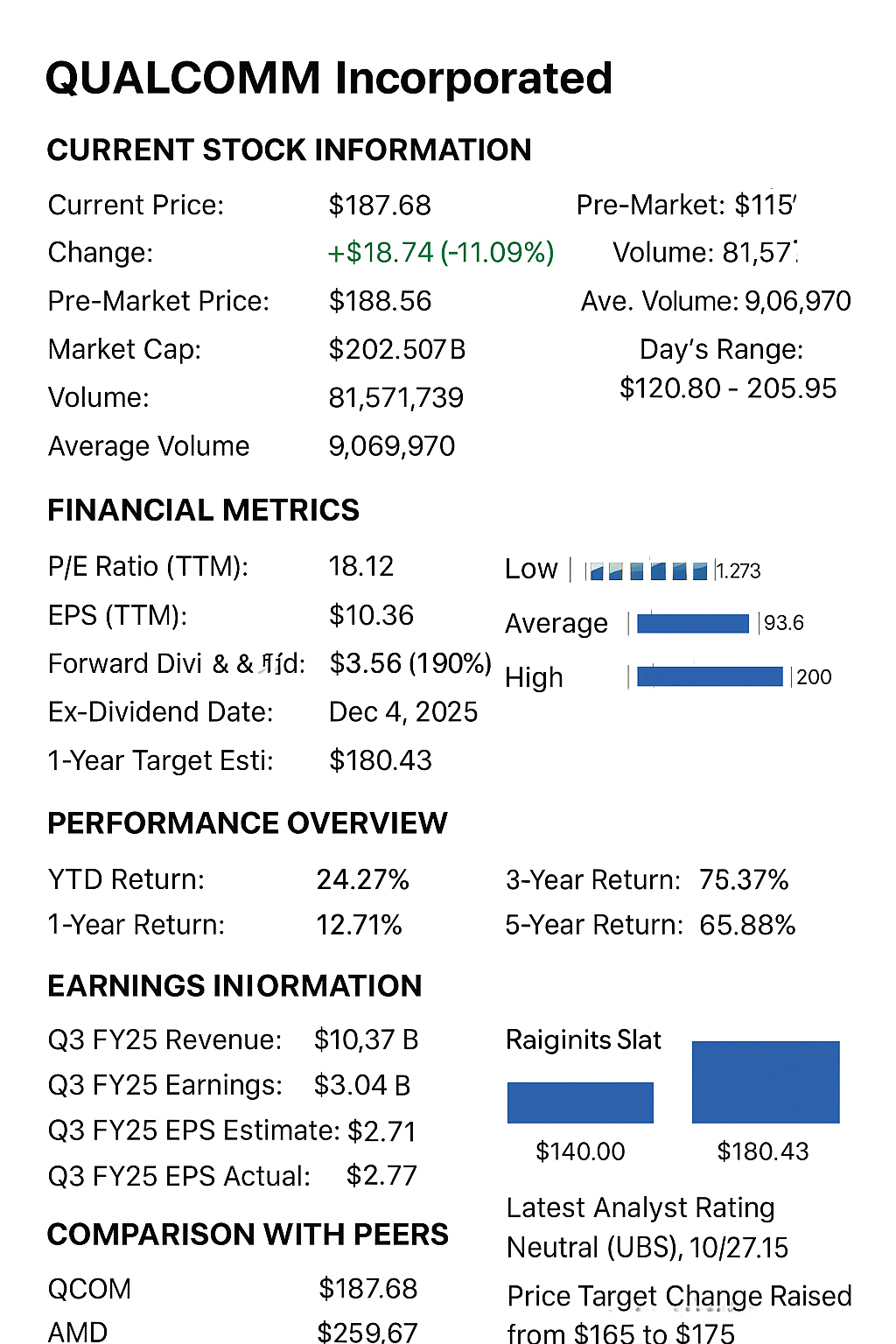

On Monday, Qualcomm stock surged over 11% after the tech giant announced its official entry into the AI data center chip market, setting its sights on rivals Nvidia and AMD. This is a daring step that shows a completely new chapter for Qualcomm, which is aligned to expand beyond its traditional stronghold in smartphone chips and licensing revenue.

A New Contender in the AI Chip Race

The Company unveiled two groundbreaking chips, the AI200 and AI250, along with full rack-scale server systems designed for data centers. These aren’t just small upgrades; they mark Qualcomm’s strategic push into a multibillion-dollar industry currently dominated by Nvidia and AMD.

- AI200: Qualcomm’s first AI accelerator chip and the name of the complete server rack that houses it.

- AI250: The next-generation accelerator, expected in 2027, promises 10x more memory bandwidth than the AI200.

- A third-generation chip is already planned for 2028, showing Qualcomm’s intent to stay on an annual innovation cycle.

Both chips leverage Qualcomm’s custom Hexagon NPU (Neural Processing Unit), technology originally developed for its Windows PC processors, now scaled up to handle massive AI workloads in the data center.

Efficiency and Affordability at the Core

One of Qualcomm’s biggest selling points is energy efficiency. The new chips are built specifically for AI inference, the process of running AI models, rather than training them. This means they’re optimized to deliver powerful performance while keeping energy costs low.

Nowadays, where the total cost of ownership is a core metric for data center builders, Qualcomm’s low-power approach could become a major advantage. The Company claims its systems will provide better performance per watt, potentially helping operators cut operational costs significantly.

A Flexible Approach for Customers

Qualcomm isn’t locking customers into a single system. Companies will be able to purchase:

- Individual AI accelerator chips,

- Specific server components, or

- Entire AI-ready racks.

According to Durga Malladi, Qualcomm’s Senior VP for Technology Planning and Edge Solutions, even industry rivals like Nvidia and AMD could eventually become Qualcomm’s customers, highlighting the complex and interconnected nature of today’s AI ecosystem.

Learning from the Past

It is considered Qualcomm’s first attempt at the data center market. Back in 2017, it introduced the Centriq 2400 platform with Microsoft, a project that ultimately fizzled out due to fierce competition and corporate distractions. But at this time, Qualcomm is much more prepared than ever.

It has already been factually noticed that with its AI 100 Ultra card, used in off-the-shelf servers, it is now moving toward fully integrated AI systems. The difference? Qualcomm has learned from past missteps and is entering the race with a clear strategy, modern infrastructure, and growing investor confidence.

Why Investors Are Paying Attention

Today, the stock market rose swiftly in response to Qualcomm’s announcement. Qualcomm stock closed up 11% at $187.68, reflecting renewed optimism among investors. The Company reported $10.4 billion in Q3 revenue, with $6.3 billion coming from smartphones. But this new generative AI pulls you towards Qualcomm diversifying its revenue streams and lessening its dependency on the volatile handset market.

Still, the map ahead will not be very easy. Qualcomm faces competition from major players like Nvidia, AMD, and even cloud giants such as Google, Microsoft, and Amazon, all of whom are developing their own AI chips.

However, Qualcomm’s combination of energy efficiency, flexibility, and proven chip design expertise could make it a serious contender in the data center AI space.

The Bottom Line

Qualcomm’s entry into the AI chip world isn’t just restricted to business expansion, but it’s a statement to mark the new beginning. By taking on giants like Nvidia and AMD, the Company is redefining its identity and positioning itself at the heart of one of the most transformative tech shifts of our time.

With investors rallying and Qualcomm stock showing strong momentum, the question now is whether Qualcomm can turn this early excitement into long-term dominance in the AI era.

Ready to take your creativity to the next level? Explore Trends Ideas

and discover what’s shaping the future of digital innovation!